The 25-Second Trick For Feie Calculator

Wiki Article

A Biased View of Feie Calculator

Table of ContentsIndicators on Feie Calculator You Should KnowSome Known Details About Feie Calculator The smart Trick of Feie Calculator That Nobody is Talking AboutFeie Calculator Things To Know Before You BuyThe Facts About Feie Calculator Revealed

US deportees aren't limited only to expat-specific tax obligation breaks. Usually, they can declare a number of the same tax obligation credit reports and reductions as they would certainly in the United States, including the Kid Tax Obligation Credit Rating (CTC) and the Lifetime Learning Credit Score (LLC). It's feasible for the FEIE to lower your AGI a lot that you do not get certain tax obligation credit reports, however, so you'll need to verify your eligibility.

The tax obligation code claims that if you're an U.S. citizen or a resident alien of the USA and you live abroad, the IRS taxes your around the world income. You make it, they exhaust it no issue where you make it. You do get a wonderful exclusion for tax obligation year 2024 - Taxes for American Expats.

For 2024, the optimal exemption has actually been increased to $126,500. There is also a quantity of certified real estate costs eligible for exclusion. Usually, the maximum quantity of housing expenses is limited to $37,950 for 2024. For such calculation, you require to determine your base real estate amount (line 32 of Form 2555 (https://www.openlearning.com/u/feiecalculator-t03qal/)) which is $55.30 daily ($20,240 per year) for 2024, increased by the number of days in your certifying duration that fall within your tax year.

Rumored Buzz on Feie Calculator

You'll have to figure the exemption initially, because it's limited to your international earned income minus any type of foreign real estate exemption you claim. To receive the international earned revenue exclusion, the foreign housing exemption or the foreign housing reduction, your tax obligation home have to remain in an international nation, and you have to be among the following: A bona fide local of a foreign nation for an undisturbed period that includes a whole tax year (Authentic Citizen Test).If you declare to the foreign federal government that you are not a homeowner, the examination is not pleased. Qualification for the exclusion might also be affected by some tax treaties.

For U.S. residents living abroad or making revenue from foreign sources, concerns frequently emerge on just how the U.S. tax system relates to them and exactly how they can make certain conformity while minimizing tax obligation responsibility. From comprehending what international revenue is to navigating various tax forms and deductions, it is very important for accounting professionals to comprehend the ins and outs of U.S.

Jump to Foreign earnings is specified as any kind of revenue made from sources outside of the United States. It encompasses a variety of economic activities, consisting of but not limited to: Salaries and incomes made while functioning abroad Bonus offers, allocations, and benefits provided by international employers Self-employment income obtained from foreign services Passion gained from foreign bank accounts or bonds Returns from foreign corporations Funding gains from the sale of international properties, such as property or stocks Profits from leasing international properties Earnings created by foreign companies or collaborations in which you have an interest Any type of various other income gained from international sources, such as aristocracies, alimony, or wagering earnings Foreign earned revenue is defined as revenue gained via labor or solutions while living and working in a foreign country.

It's essential to differentiate international gained revenue from various other sorts of foreign revenue, as the Foreign Earned Revenue Exclusion (FEIE), a beneficial united state tax obligation benefit, particularly applies to this group. Investment revenue, rental revenue, and passive income from international sources do not receive the FEIE - FEIE calculator. These sorts of earnings might undergo different tax treatment

resident alien who is that citizen or resident of nationwide country with nation the United States has an income tax treaty tax obligation effect and impact is a bona fide resident of citizen foreign country or countries for an uninterrupted period nonstop duration an entire tax yearTax obligation or A U.S. citizen or person U.S.

Foreign united state income. You must have a tax obligation home in an international nation.

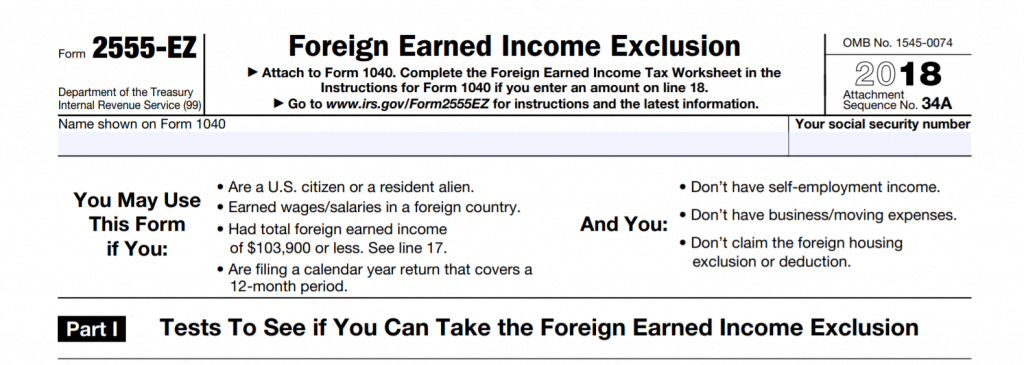

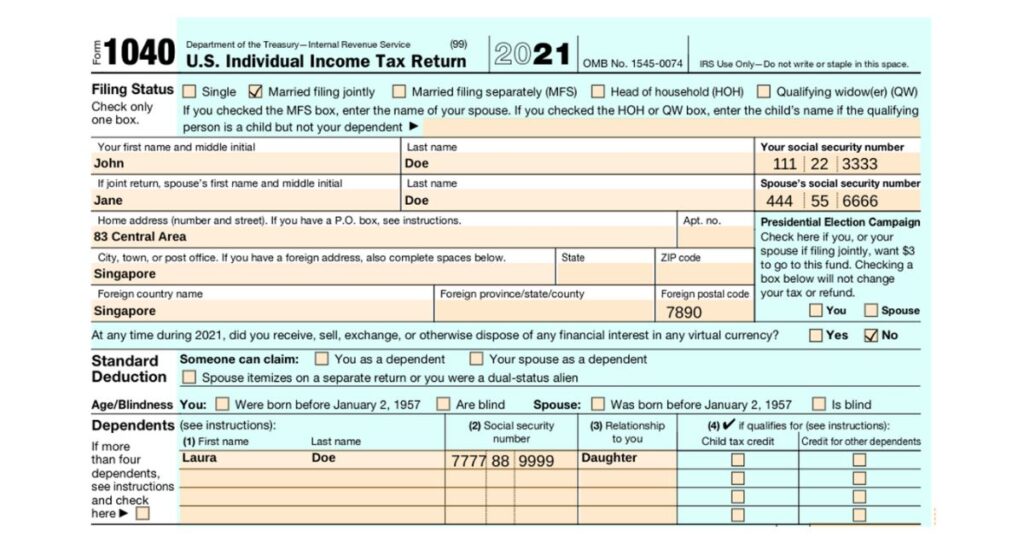

income tax return for international income tax obligations paid to an international government. This credit can counter your U.S. tax obligation liability on foreign income that is not eligible for the FEIE, such as investment revenue or passive earnings. To declare these, you'll first have to qualify (Taxes for American Expats). If you do, you'll then submit added tax return (Kind 2555 for the FEIE and Type 1116 for the FTC) and connect them to Type 1040.

The Ultimate Guide To Feie Calculator

The Foreign Earned Income Exclusion (FEIE) permits eligible people to exclude a part of their foreign earned revenue from united state taxation. This exclusion can substantially minimize or get rid of the U.S. tax obligation responsibility on foreign income. Nevertheless, the specific amount of international revenue that is tax-free in the united state under the FEIE can alter yearly as a result of inflation adjustments.Report this wiki page